Home insurance misconceptions - cement your cover

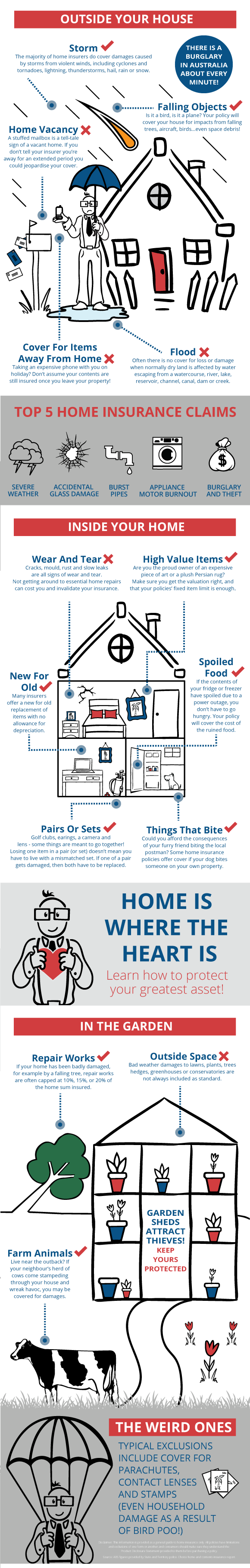

From storm damage to dog bites and the puzzle over home vacancy- many home owners are in the dark about what their policies will cover. A common assumption is that flood cover is automatically built into most house insurance policies which isn’t always the case. Got a prize-winning garden to protect? You may want to check the fine-print before hedging your bets. If you don’t know much about your cover our home insurance misconceptions infographic has you covered!

EMBED INFOGRAPHIC ON YOUR SITE

<p><a href="https://www.compareinsurance.com.au/home-insurance/guides/home-insurance-misconceptions"> <img src="https://www.compareinsurance.com.au/assets/content-img/home-insurance-misconceptions.png" width="580" alt="From storm damage to dog bites to the puzzle over home vacancy – many homeowners are often in the dark about what their policy will cover. This infographic has the answers!" /></a><br /> Infographic by: <a href="https://www.compareinsurance.com.au">Compareinsurance.com.au</a></p>

Home is where the heart is

Home is where the heart is, so it’s only natural to want to protect your greatest asset. Most do realise that insurance is a vital investment, however many property owners are unaware of the exclusions that apply to their home and/or contents policy. A solid understanding of the fine print and knowing where you are and aren’t covered is crucial.

Weather can be a huge factor when it comes to policy confusion. Heavy rainfall in the lead up to the hotter months, and then the threat of bushfire damage increases considerably. With unpredictable and hazardous weather conditions, it’s essential for property owners to understand their policies.

Know your cover

It’s not just that some things aren’t covered, it can often be the case that the insurer didn’t know about something so is unable to pay a claim. To avoid losing out, follow these tips:

- Make sure you disclose all new modifications to your house that could affect its value. Be honest with your insurer- if you said you had deadlocks and you didn’t you could be in trouble. See what else might not be included in your policy.

- Keep proof - Receipts, photos, serial numbers are all worth holding on to so you can prove your purchase in case of theft.

- Prevention and vigilance – we can’t always predict damage and disasters, but we can be prepared. A good home security system, along with common sense (i.e. never leaving your door unlocked) will deter burglaries. We've got plenty more tips to help you get the right cover for your needs.

- Know your cover - Understanding your home insurance policy, and ensuring you have the adequate cover for your circumstances is the best way to avoid paying for unexpected repairs and thefts to your property.

The crux of home insurance cover is all in the detail. Lengthy as it may be, it’s essential to review your policy documentation (Product Disclosure Statement) if you haven’t already. Take note of all the different exclusions that apply to your policy.

All policies have limitations and exclusions of one form or another and consumers should make sure they understand the PDS provided to them before purchasing a policy.

-

Highly recommended

How to save on your home insuranceThere are many factors that influence the cost of your premiums. The good news is there are plenty of ways to keep costs down.

... Read more. -

Highly recommended

What does home insurance not cover?Home insurance policies come in all shapes and sizes and all have slightly different benefits and exclusions to pay attention to.

... Read more. -

Highly recommended

Home insurance misconceptions - cement your coverFrom storm damage to dog bites and the puzzle over home vancancy- many home owners are often in the dark about what their insurance will cover.

... Read more.